SmartPay leverages it’s payment processing expertise to deliver effective payment processing solutions to all industries. We understand the diverse needs of being able to process online, over the phone and of course in a typical retail environment. If you are a new business applying for a merchant account give us the opportunity to serve you and walk you through our simplified process.

SmartPay delivers on simplified solutions that combine traditional cash payments, credit card processing, and electronic check acceptance with new mobile payments and loyalty card programs. We also offer the latest in iPad Point of Sale Cash Register Systems, Virtual Terminals, Software and secure Payment Gateways for E-Commerce credit card processing. SmartPay can help you navigate the latest changes in card technology from the acceptance of EMV cards, Contactless cards to Near Field Communication (NFC), using your smartphone as your credit card.

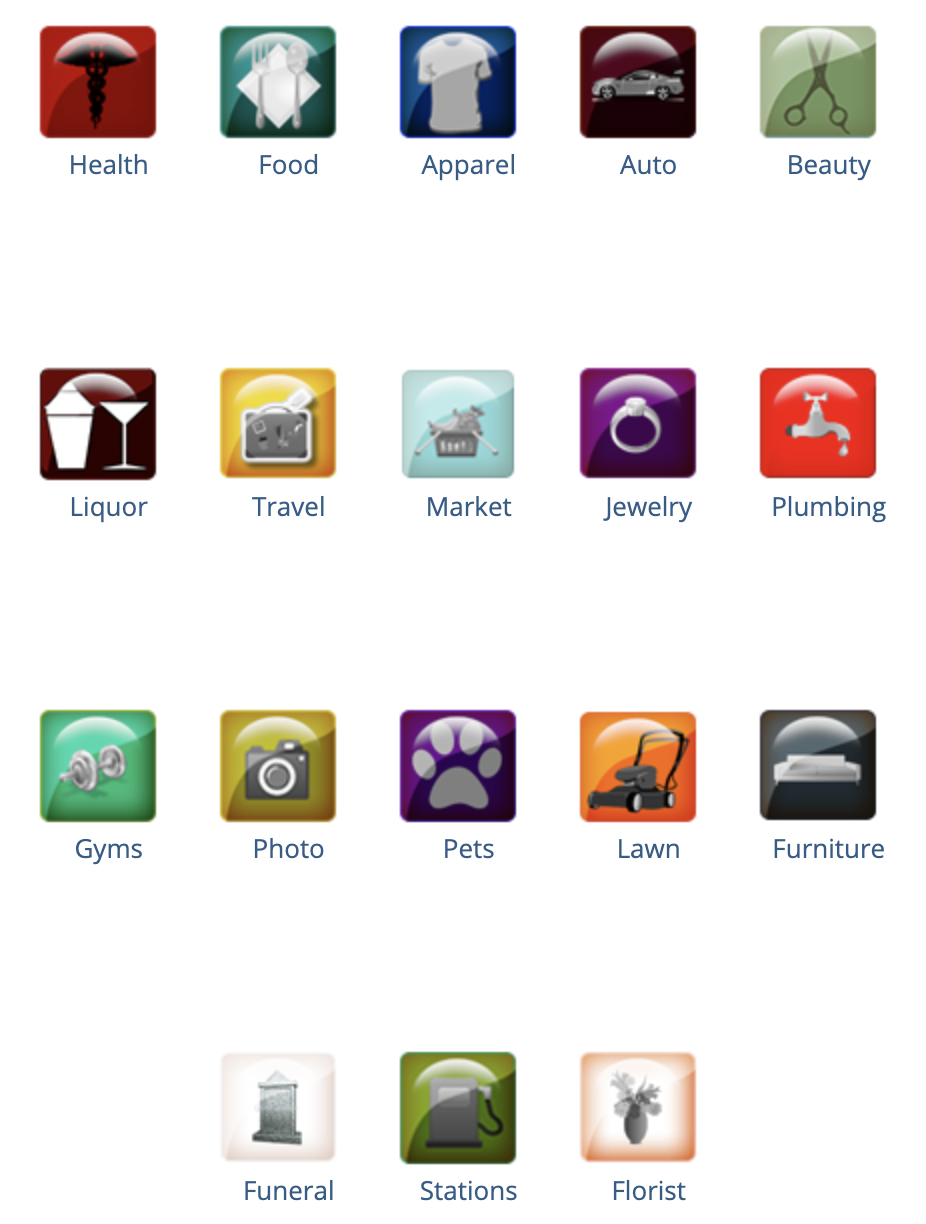

SmartPay has a vast range of products and services, each one hand picked to provide the greatest return on investment for our customers. Take a look at our “Learn More” section to see our highly requested Top Ten Services from businesses like yours.

A Relationship Manager, will be introduced to you when your establishment is up and processing. They will address policy issues and provide new products and opportunities, as they become available to the client. The Relationship Manager will ultimately assume the role of overseeing the client’s needs throughout its relationship with SmartPay Merchant Services.

Free Online Reporting

Our web-based reporting services at www.FDPortfolioManager.com is a secure Internet service that provides immediate, real-time access to daily deposits by card type and by location. FDPortfolioManager.com also lists status updates on chargebacks and all facets of your transaction activity. Reports can be generated for daily, weekly, and monthly to tie into your financial periods or for simple periodic inquiries. This reporting option is provided free of charge.

Our Values define us as a company, if we can take the complexities of a business and reduce it down to the bare essentials, these are the things that make up who we are and how we conduct ourselves.

EXCELLENCE:

Always doing what is right and going over and above the average expectation.

LEADERSHIP THROUGH SERVICE:

Taking care of the needs of the customer in a timely, responsive manner, while providing continuous training to help them process more efficiently and reliably

ACCOUNTABILITY:

To Visa, MasterCard, Business owners, and their customers.

INTEGRITY:

Conforming our actions to our Word, to meet our commitments to you.

TEAMWORK:

Building relationships in the community with business owners, referring them business and shopping at their stores.

HELPING OTHERS:

Giving back to the community by helping a local homeless shelter and helping businesses understand the complexities of merchant service.

We are committed to helping our local homeless shelter. This shelter provides housing and supportive services to women and children who are striving to break the cycle of homelessness. A portion of your fees that you pay on a monthly basis for credit card processing will go on to help end homelessness for Women and Children.

EMV (Euro Mastercard Visa)– Future Proof your Business

From the world’s largest corporations to small Internet stores, compliance with the PCI Data Security Standard (PCI DSS) is vital for all merchants who accept credit cards, online or offline, because nothing is more important than keeping your customer’s payment card data secure. The size of your business will determine the specific compliance requirements that must be met. Lack of education and awareness around payment security, coupled with poor implementation and maintenance of the PCI Standards, gives rise to many of the security breaches happening today. The PCI DSS and PA-DSS are constructed in a way that their principles can be applied to various environments where cardholder data is processed, stored, or transmitted—such as e-commerce, mobile acceptance, or cloud computing.

Information

| Date | What’s happening? | Notes and resources |

|---|---|---|

| October, 2012 | Visa will encourage EMV chip-enabled transactions Effective October 1, 2012, Visa will expand its Technology Innovation Program (TIP) to the U.S. TIP will eliminate the requirement for eligible merchants to annually validate their compliance with the PCI Data Security Standard for any year in which at least 75 percent of the merchant’s Visa transactions originate from chip-enabled terminals. To qualify, terminals must be enabled to support both contact and contactless chip acceptance, including mobile contactless payments based on NFC technology. |

Reference:

http://corporate.visa.com/media-center/press-releases/press1142.jsp |

| April, 2013 | Visa will require EMV chip card acceptance Visa will require U.S. acquirer processors and sub-processor service providers to be able to support merchant acceptance of chip transactions no later than April 1, 2013. Chip acceptance will require service providers to be able to carry and process additional data that is included in chip transactions, including the cryptographic message that makes each transaction unique. |

Reference:

http://corporate.visa.com/media-center/press-releases/press1142.jsp & http://www.mastercard.us/mchip-emv.html |

| October 2015 | Visa will establish a Counterfeit Fraud Liability Shift Visa intends to institute a U.S. liability shift for domestic and cross-border counterfeit card-present point-of-sale (POS) transactions, effective October 1, 2015. | Reference:

http://corporate.visa.com/media-center/press-releases/press1142.jsp & http://www.mastercard.us/mchip-emv.html |